Haven’t planned your retirement yet? Here is a solution that we have for you. In India, it is common to prioritize short-term goals and goals including Kid’s Education, Kid’s Marriage, & others over Retirement. Often times, the aforesaid goals can be a matter of pride.

As a result, Retirement is given the lowest priority. But when an individual is edging closer to 40s or 50s, they tend to realise or regret not planning their retirement earlier.

In the aftermath, they might never retire and this approach is not tenable. Here is how you could better approach it.

Scenario - Mr. Tarun Kumar, 40 has been an IT professional for 18 years. He had opted for a lower contribution to Employee Provident Fund (EPF) in his organisation. Therefore, his EPF balance is negligible and does not want it to be considered. His savings are sufficient to meet his daughter’s graduation which is a few years away. He desires to retire at 60 years of age but worries that it may not be possible. He needs a minimum of Rs. 50,000 per month to survive post-retirement, he is earning Rs. 2 lakhs per month (take-home) post taxes, and his expenses are at 1,50,000 per month and does not have any lumpsums to invest. What could he do?

Answer - Mr. Tarun has 13 years to plan his retirement and does not have any existing investments. While keeping in mind a retirement income of Rs. 50,000 per month in today’s value (kindly refer the assumptions below), he will need a corpus of Rs. 3.14 crores (approx.) at 60 years of age.

To achieve this, he will need to contribute Rs. 31,812 per month for 20 years with a return of 12% p.a.* Given his investment potential post expenses, he should be able to contribute Rs. 31,812 per month with ease.

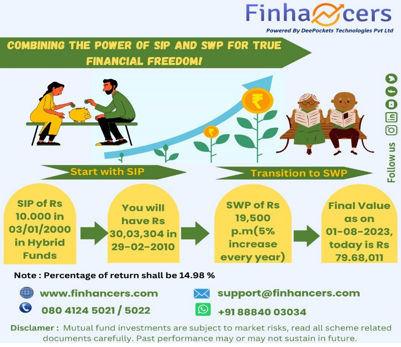

The regular investments could be made in Diversified Equity Funds during the pre-retirement phase. Post retirement, one can Systematically Withdraw an inflation adjusted amount of Rs. 50,000 per month in today’s value from Asset Allocator Funds. An increment of 6% p.a.* can be taken every year to make up for the inflation.

Refer the below scenario for better clarity. The below is for illustrative purposes only and the numbers are not relevant to the above scenario -

Stop Regretting, Start Investing! To know more, contact us at 080-4124 5021/5022 or email us at support@finhancers.com

*Note - Inflation of 6% p.a. is assumed, A return of 12% p.a. is assumed for pre-retirement (aggressive risk profile), life expectancy of 80 years is assumed, return of 8% p.a. is assumed for post-retirement.

Disclaimer - Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns. Performance of any investment portfolio can neither be predicted nor guaranteed.