Mutual funds come with a host of benefits and flexible methodologies like a Systematic Investment plan (SIP) to make regularly investments, a Systematic transfer plan (STP) to park funds in safer debt options and then move to Equity Funds in a staggered way periodically, Systematic Withdrawal Plan (SWP) to withdraw systematically with less tax implication than the dividend one from the invested funds.

Please note that Mutual Funds do not guarantee any returns. In this strategy, partials withdrawals shall be available for a regular income. Further, we shall also aim for capital appreciation on the invested amount.

Isn't this a smarter way of investing?

The strategy does not require daily tracking, as the funds are invested through an expert fund house.

Please note that Markets are volatile in the short to medium term, so as a result, it will deliver the desired returns only over a seven year period.

We have been adopting a combo of the said strategy in the portfolio of investors to get the investors a minimal risk with better returns. We have showcased a simulation for a better utilization of your funds.

We do not recommend any scheme through this, and the funds have been taken for a better understanding. The returns shown here are not imaginary figures. It is based on an actual back testing.

Sensex is at its all-time high!

Yes, of course but it does not mean you should avoid investing. We would suggest you to think of the time you will spend in the markets for better returns. If you want your funds to be deployed in a staggered way to make the best use of the roller-coaster ride in the markets, then here is a combo strategy for you.

Let us explain a bit more.

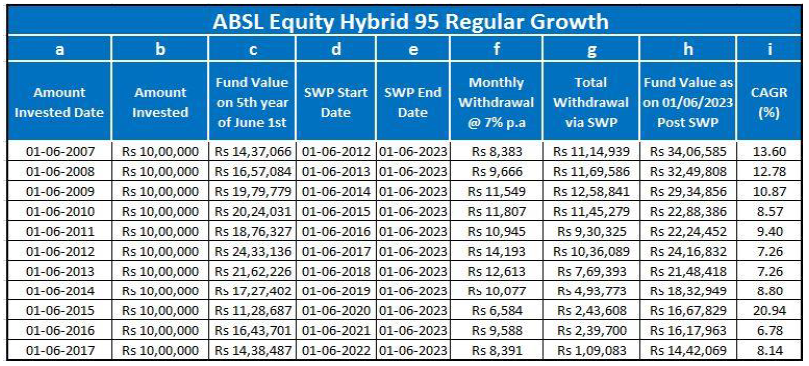

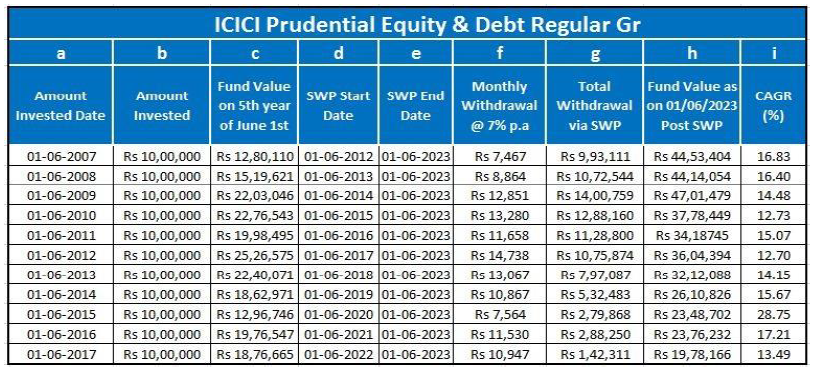

We have first taken and analyzed the Category- Hybrid Equity and Debt fund. This category would invest a minimum of 65% in Equity and the rest in Debt.

In the below example, a Lump sum is invested. Subsequently, the funds are left untouched for five years. Then a systematic withdrawal @ 7% per annum is made from 2007. Check the interesting results here -

Column (a) Shows the different investment periods, Column (b) shows the lump sum investment amount of Rs.10 Lakhs), then funds were left untouched, and the value at the end of five years is shown in (c) Then systematic withdrawal starts past five years, and the SWP start date is mentioned in (d) and @ 7% p.a. from the appreciated amount as in (f), Column (g) talks about the overall withdrawal amount until 1st June 2023 and Column (h) shows the fund value as on 1st June 2023 delivering the CAGR as in (i).

Patience is the key to reap the best possible returns! Enjoy the best of both worlds today.

Disclaimer: Mutual Funds are subject to market risks. The figures and funds provided are for illustrative purposes only. The figures taken are the actual ones and past performance is not the indicator of future. So, kindly read the scheme related documents, understand your investment horizon, and risk profile before investing. Also the said schemes are not the recommendations to all the investors and we request you to do your own due diligence or meet an advisor before investing.