What is Multi-Asset Investing?

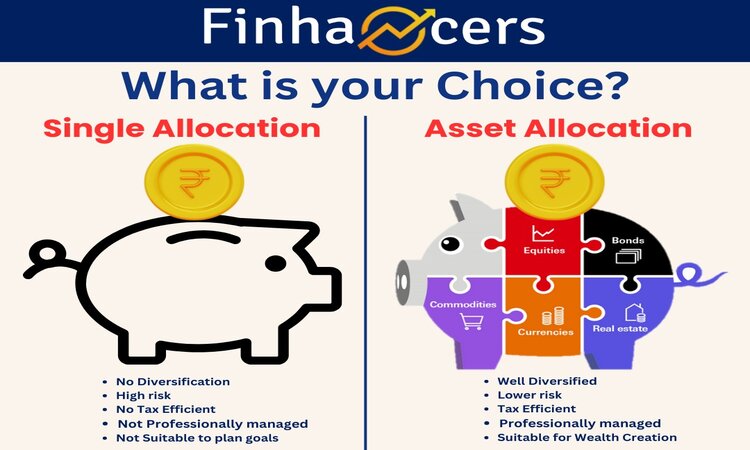

A Multi-Asset investing refers investment in variety of asset classes such as Indian Equity, Overseas Equity, Bonds, Commodities like Gold & Silver, Real Estate, & etc.

Multi-Asset Allocation Funds are meant to have a minimum of ten percent (%) in any of the above said asset classes as per SEBI guidelines. This is one of the viable ways to invest in Multiple Asset Classes.

Why Multi-Asset Investing?

1. Broadly diversified portfolio

2. Could perform even during a crisis

3. Relatively Lower risk

4. No bias

5. Consistent returns

6. Tax efficient

Which is better- Gold or Equity or Debt or Real Estate or Overseas Equity?

Source: Funds India Wealth Conversation Report June 2023. Returns as on May 31, 2023.

The above chart shows the behaviour asset classes NIFTY 50, S&P 500, Gold, Real Estate, and Debt for a 10-year period. In a 1-year period till 31st May 2023, Gold has outperformed all asset classes. But in a 3-year period, NIFTY 50 TRI has outperformed all asset classes.

In a 5-year, 10-year, and 15-year period, U.S. S&P 500 TRI has outperformed all classes. Comparatively, In a 20-year period, Indian NIFTY 50 stands atop with 17.2% CAGR.

An individual with only one asset-class, perhaps Real Estate would have seen relatively low growth. Similarly, a person holding NIFTY 50 alone may have experienced consistent growth but could have missed opportunities in the overseas markets.

To answer the question of which asset class is better, it is important to know that no one asset class is the best. Equity help generate a high return but can a underperform during a crisis. Gold is considered to be a safe haven during times of crisis. Real Estate is known to have a very low correlation with the equity markets. Debt (Fixed Deposit and bonds) can be a safe avenue to park money.

This analysis is meant to show the need for one to invest in multiple avenues to generate a consistent return

Click here to know the top performing Multi-asset Allocation Funds.

How Do I Invest in Multiple Asset Classes?

To know more about Multi-Asset Allocation Funds, how you can invest, and whether if it suitable for you at this juncture, do contact us at 080-4124 5021/5022 or email us at support@finhancers.com

or

You can also click and fill the form below-