Before investing, it is essential to have adequate protection. Creation of a three-step protection plan for your family is imperative. A three-step protection plan does not simply mean having sufficient funds for emergencies, a health insurance, and a term insurance plan. It means more.

What constitutes a Three-Step Protection Plan?

1. Emergency Fund - How long might you need get a new job if you exit the current job?

If the time needed is six months, then your Emergency Fund should help cover for six months. If you are an entrepreneur, a 12-month reserve is a must.

Ideally, an Emergency Fund should help cover Basic Living Expenditure, Premiums, & Systematic Investment Plans (SIPs).

2. Insurance - There are two types of insurance, namely a) Term Insurance and b) Health Insurance Plan.

For Term Insurance, Human Life Value calculation shall offer clarity in reference to the cover needed. Ideally, the sum assured chosen should help the family meet various goals like kid’s education, car purchase, retirement, & etc. Critical Illness and Accidental Death add-ons may be considered as well. Term Insurance premiums rise with each passing age. So, the sooner one opts for it, the better.

For Health Insurance, the requirement shall vary from person to person based on the age, job profile, pre-existing illnesses, & family.

It is suggested to have a health insurance plan aside from the one offered by the organisation as there may be restrictions on claims, change in policy guidelines, or you might exit the organisation at some point.

3. Health Corpus -

Post retirement, your Health Insurance premiums may skyrocket, and at times, the cover may be insufficient to cover any major surgeries post-retirement.

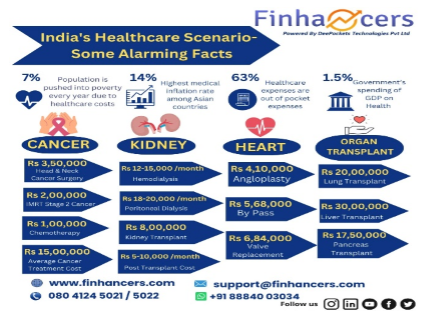

So, it is imperative to have a health corpus. Here is a chart highlighting some alarming facts about India’s health scenario -

Why Is It Needed?

Many individuals face issues while switching jobs for a higher salary or better responsibilities due to fear. Fear stems from a lack of contingency planning. Only 25% of Indians have emergency funds for a rainy day, according to a survey titled India's Money Habits by Finology.

The common consensus on insurance is that it is "expensive" or "a waste of money", or "I am healthy, I do not need any protection, so I shall plan for my long-term goals."

As per IRDAI, around 75% of Indians pay for medical services from their pocket. As per studies, 30 people out of 100 have a life insurance policy in India. Only a fraction of the above have a health corpus. With healthcare costs rising at a staggering rate of 12% p.a. every year, building a health corpus is non-negotiable.

Do you know you can build a health corpus of Rs. 50,00,000 with an SIP of just Rs. 5,000 @ 12% for 20 years?

Do you also know that for a term cover of 50 lakhs for a 25-year-old male would only cost 48.6 rupees a day?

What are you waiting for? To know more, kindly fill the below form -

https://forms.gle/XVMJ7jXzFJjuvM4T9

Disclaimer - Investments are meant to be tailor-made and vary from individual to individual based on several factors including age, goals, time horizon, and more. Therefore, no part of this article must be construed as advice. This article is only meant to spread knowledge. Kindly contact your advisor for any relevant information.