Accidental death cover is a type of insurance that provides coverage in case of death of the insured due to an accident within the policy period, the nominee (as declared by the insured) is compensated with the sum insured. Did you know? Individual accident insurance pays compensation against the permanent and total loss of limbs, sight etc. Due to an accident within the policy period. Permanent total disablement shall mean total and irrecoverable:

1) Loss of sight of both eyes; or

2) Actual loss by physical separation of both hands or both feet or one entire hand and one entire foot, or

3) Total and irreversible loss of use of the both hands or both feet or of one hand and one foot without physical separation;

The cover under the policy expires after a claim has been paid under any one of these insured events.

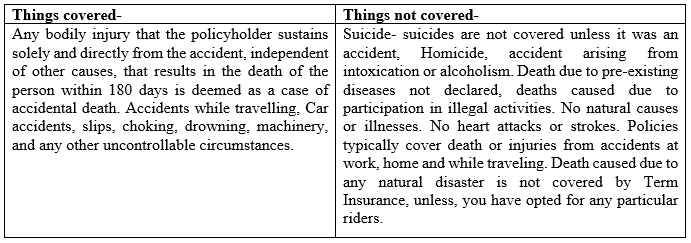

What does it cover? - Any death or permanent disablement arising out of an accident will be cover under this policy. Check the table below to have a better idea.

Benefits -

1) Financial Protection: Accidental death cover provides a financial safety net for your loved ones or beneficiaries in the event of your accidental death.

2) Affordability: Accidental death cover is generally more affordable than traditional life insurance policies.

3) No Medical Exam: Many accidental death cover policies do not require a medical examination or extensive underwriting. This can make it easier to obtain coverage.

4) Worldwide Coverage: Accidental death cover often provides worldwide coverage.

5) Additional Benefits: Some accidental death cover policies offer additional benefits, such as coverage for medical expenses resulting from accidents.

To know more, Contact us - +91 884003034, Email ID - support@finhancers.com